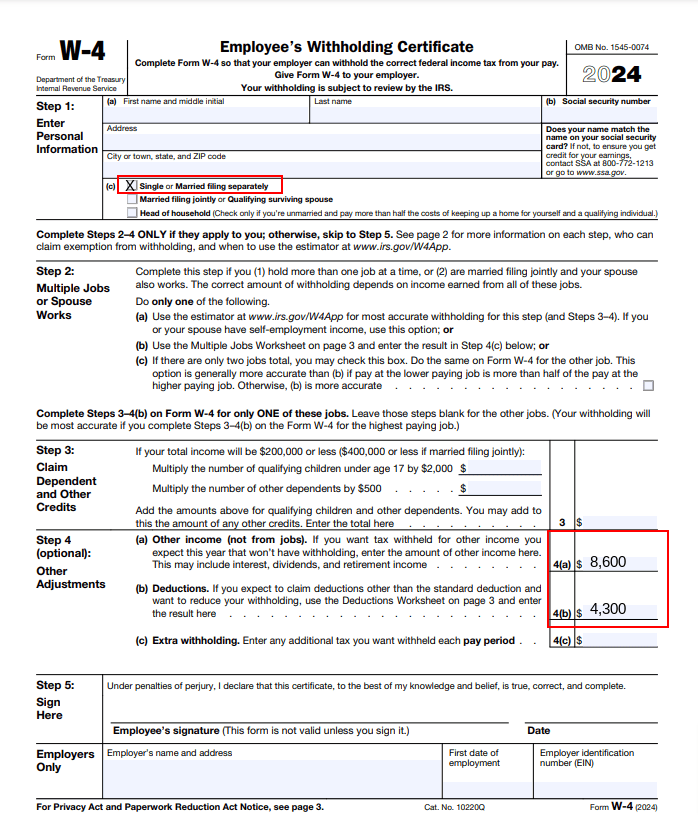

New W-4 Forms For 2024 Social Security – • Form W-4 changed because the Tax Cuts and Jobs Act removed personal exemptions, increased the Standard Deduction, and made the Child Tax Credit available to more people. • As before, you . A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer Fill in your name, address, Social Security number and tax filing status. .

New W-4 Forms For 2024 Social Security

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comEmployee’s Withholding Certificate

Source : www.irs.govHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comNavigating 2024 W 4 Changes: Tips for HR Leaders | Inova Payroll

Source : inovapayroll.comNew W-4 Forms For 2024 Social Security 2024 Form W 4P: Start with Adjusted Gross Income (Line 11-IRS Form New Mexico, Rhode Island, Utah, Vermont, and West Virginia. Beginning in 2024, Missouri and Nebraska will stop taxing Social Security benefits. . As we enter the 2024 proxy season resulted in a restatement that triggered a clawback analysis; and new Item 402(w) of Regulation S-K requiring certain disclosures in Forms 10-K and proxy .

]]>